Renewable Energy Financing and Solar Panel Funding for UK Industrial and Commercial Sites

Finance and operations leaders in UK manufacturing, warehousing, and commercial property are looking into renewable energy funding to manage costs and plan for the future. Solar energy financing has become a reliable option for protecting profit margins, lowering exposure to unpredictable markets, and supporting sustainability goals without requiring large upfront investments.

Before giving the green light for a project, finance teams want clear information. The business case needs to be straightforward, realistic, and supported by trustworthy examples. This guide addresses common questions about renewable energy loans, commercial solar financing, and solar panel funding, using real figures and an honest, balanced approach.

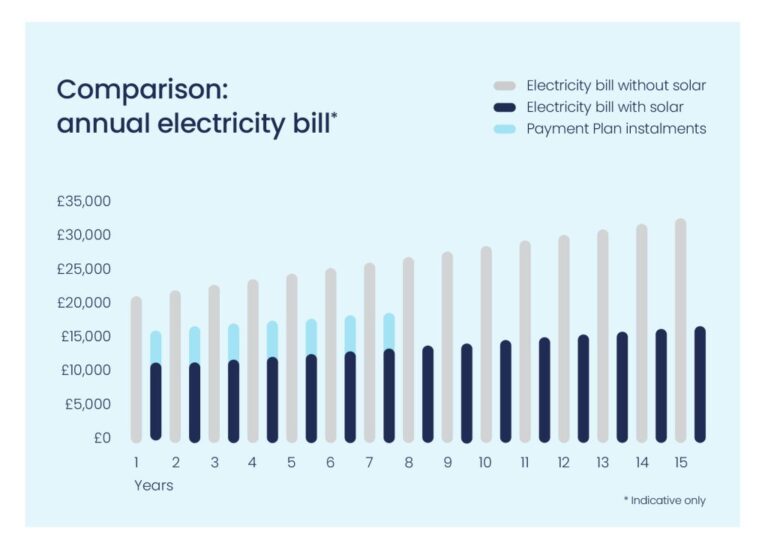

There is also a simple but important point to consider. If businesses can handle their current energy bills, they can handle solar costs. The expense shifts from an unpredictable utility bill to a fixed repayment plan that provides long-term value.

Key Questions Finance Leaders Ask About Solar Energy Financing

Can solar systems be financed?

Yes. Most commercial and industrial sites use renewable energy financing or structured asset finance to pay for their solar installations. This keeps capital available for operational needs.

What are the benefits of solar financing solutions for businesses?

Benefits include predictable costs, good returns, less exposure to energy price changes, tax savings, and immediate operational savings.

What are the best solar panel finance options?

The most common options include hire purchase agreements, asset finance, renewable energy loans, and special solar panel loans meant for commercial installations.

How much is solar panel financing?

This depends on the system size, equipment choice, installer pricing, and term length. Often, monthly repayments are lower than the monthly energy savings.

Is renewable energy funding appropriate for manufacturing sites?

Yes. Industrial buildings tend to benefit the most from solar energy financing because they use a lot of daytime electricity, which can be offset directly by onsite generation.

Why Renewable Energy Funding is Driving Board Level Decisions?

Commercial energy costs are one of the most unpredictable parts of operating expenses. For many businesses, solar funding takes away this uncertainty from their balance sheet. Renewable energy financing turns an uncontrolled expense into a fixed repayment schedule. This provides cash flow certainty, which is crucial for finance directors and budget managers.

Solar panel funding also helps keep working capital concentrated on activities that generate revenue. At the same time, operational teams acquire a long-term energy asset that decreases reliance on the grid and improves site resilience.

Main Types of Commercial Solar Energy Financing

Hire Purchase Agreements

This is one of the most common options for industrial solar projects. Businesses pay monthly until the end of the term and own the system outright. Payments are fixed, which makes forecasting easy. Capital allowances might be available depending on the tax rules in place.

Asset Finance for Solar PV

Asset finance spreads the cost of a commercial solar system over a set period. It works well for manufacturers and large commercial sites that want simple repayments that match the savings generated by the system.

Solar Panel Loans and Renewable Energy Loans

These loans are meant for businesses that prefer traditional lending arrangements. The business owns the asset from installation and pays it back through a fixed loan schedule.

PPA Structures

A power purchase agreement involves a third party installing and owning the system while selling electricity to the business at a set rate. This approach works well for organisations that want renewable energy without a financial commitment or upfront capital expense.

Customer Story: My Furniture and Smart Ease Finance

A recent 574 kW solar and battery project for My Furniture in Nottingham shows how renewable energy financing helps companies take action sooner and keep control of their money.

Director Dimitrios Pappas explained the impact clearly.

“The Smart Ease Payment Plan made the project affordable from day one. We spread the cost over time, started enjoying savings right away, and the whole process was smooth and clear. We now wonder why we didn’t do it sooner!”

Stories like this show a wider trend. Businesses want predictable monthly costs and immediate energy savings, and renewable energy funding offers that.

Example: Financial Model for a 500 kWp Industrial Solar System

Below is a practical example from an Excel Energy assessment for Business A, a typical manufacturing company with consistent daytime demand.

Business Profile

- Annual usage: 750,000 kWh

- Operating hours: Mon to Fri 8am to 5pm, Sat 8am to 1pm

- Annual energy spend: £160,000

- Import rate: 20p per kWh

- Export rate: 8p per kWh

- Roof area: Large south facing roof

Solar System Overview

System Details | Figures |

System size | 500 kWp |

Annual generation | 500,000 kWh |

Assumed onsite usage | 65 percent |

Export ratio | 35 percent |

System Cost Options

Option | Equipment Type | Cost |

1 | Optimised inverter | £292,320 |

2 | Standard string inverter | £272,160 |

3 | Hybrid inverter | £278,160 |

Annual Benefit Calculation

Category | Calculation | Value |

Onsite savings | 325,000 kWh at 20p | £65,000 |

Export income | 175,000 kWh at 8p | £14,000 |

Total annual benefit |

| £79,000 |

Finance Example: Smart Ease Hire Purchase

Indicative monthly payments:

Term | Monthly Payment plus VAT |

84 months | £4,653.82 |

72 months | £5,293.07 |

60 months | £6,122.53 |

Many industrial sites achieve a neutral or positive cash position immediately because their electricity savings outweigh their monthly finance repayments.

Why Industrial and Manufacturing Buildings See Strong Returns?

Industrial sites usually run long daytime shifts, so most solar energy is used right away. This high onsite use offers a good return on investment and lowers dependence on lower-value export tariffs.

For finance teams, renewable energy financing is a smart investment that offers predictable costs and a lasting operational edge. For operations leaders, it boosts energy reliability and lowers the risks of downtime due to grid instability.

Strategic Value for Finance and Operations Leaders

Renewable energy financing and commercial solar energy funding are now crucial for UK businesses seeking stability, better margins, and control over long-term energy costs. Structured solar panel loans, asset finance, and hire purchase agreements enable organisations to invest confidently without depleting capital reserves.

If the business can manage its current energy bills, it can also afford solar. This choice serves as a proactive financial move that shields the organisation from rising costs and promotes sustainable growth.

Solar has moved beyond experimentation. It is now a reliable, strategic asset backed by solid data, good financing options, and proven real-world results. When the numbers are analysed correctly, the business case is clear.