Smart Ease Finance Approved Partner

Smart Ease is a digital-first funding provider backed by a team of experts in the smart-tech and renewable-energy industries. Our platform and people deliver competitive rates, fast approval and a dynamic, responsive experience from start to finish.

Excel Energy is excited to announce a new partnership with finance provider Smart Ease, making solar energy more financially accessible for businesses across the UK. Based in London, Excel Energy, a renewable energy specialist, aims to simplify the transition to solar energy through this collaboration.

The partnership will make it easier for businesses to access funding for renewable energy technologies.

Switching to renewable energy systems is one of the best ways businesses can guarantee long-term energy security and limit their exposure to future energy price volatilities.

Please reach out to us today to learn how Excel Energy and Smart Ease can take your business to the next level.

The need for renewable energy solutions and How To fund it

With rising and volatile commercial energy prices, many businesses are searching for alternatives to manage their energy costs. Switching to renewable energy systems offers long-term energy security and shields businesses from future energy price fluctuations.

When it comes to cutting energy costs and decarbonising your operations, choosing solar and energy-efficiency equipment makes sense. But the upfront cost can put these opportunities out of reach.

That’s why we decided to offer payment solutions from Smart Ease, industry specialists for over 10 years. Smart Ease’s competitive Payment Plan terms enable your business to pay for equipment overtime with £0 to pay upfront.

Through this partnership, Excel Energy and Smart Ease will offer a range of payment options designed to help businesses find the ideal funding solution. Smart Ease payment options can be used to fund equipment across solar power and battery storage, EV chargers, HVAC and more.

smart ease rental and hire purchase agreement

Payment Plans – Rental and Hire Purchase Agreement

With a Rental Agreement, Smart Ease owns the equipment for the duration of the Payment Plan. You can offer to buy it at the end of the term. This is typically a fully tax-deductible operating expense.

With a Hire Purchase Agreement, you own the equipment and may be able to claim the interest and depreciation on the equipment as a tax-deductible expense.

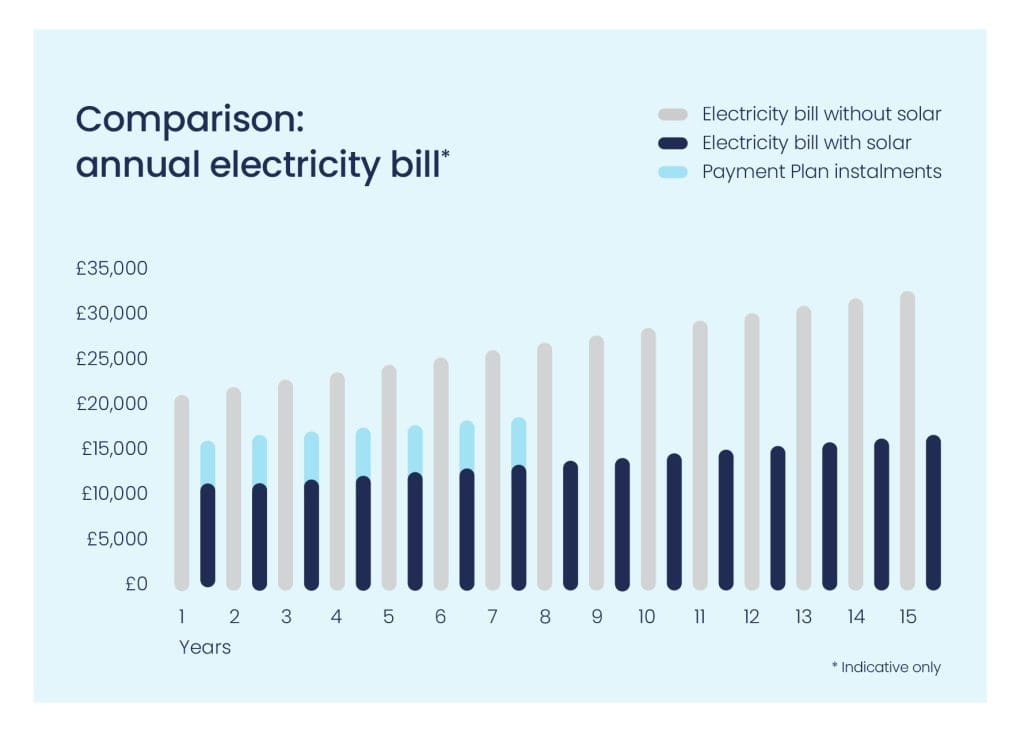

When you buy equipment on a Payment Plan, savings on your energy bills can often add up to more than the instalments for your new equipment, putting cash back into your bottom line.

With Smart Ease Payment Plans for solar panels, battery storage, and associated equipment, you can save instantly, control electricity costs, and move towards your sustainability goals.

Smart Ease Payment Plans are ideal for commercial solar projects of all sizes. They’re fast, fuss-free, and 100% online, and applications up to £150,000 can be pre-approved in around 4 minutes.

Features

✅ £0 upfront

✅ £150k instant pre-approval

✅ Competitive rates

✅ 4-min application & fast approval

✅ Up to 10-year payment terms

✅ Lower energy bills

✅ Stay on top of cash flow

✅ Tax benefits

smart ease power purchase agreement

Power Purchase Agreements (PPAs)

An onsite solar PPA is a long-term electricity supply agreement that allows you to install a solar system on your premises without the capital outlay.

A further benefit of the PPA approach is that the provider takes full responsibility for installing, maintaining, and insuring the solar panels and sells you the electricity it generates at an agreed-upon low rate (c/kWh).This makes it particularly suitable for large or complex solar installation sites or in cases where businesses want peace of mind with the assurance that the asset is in expert hands.

Features

✅ £0 upfront

✅ Long-term savings

✅ No maintenance, operations or insurance

✅ Accurate sustainability data and reporting

✅ System upgrades included

✅ Increased building value

Your PPA provider owns, operates and maintains the system and if the energy rates return to levels we experienced in 2022/23, businesses can expect to save up to 50% on their energy costs, with no up-front investment.

PPA providers typically sell electricity back to the business at around 12-15p per kwh, which used to be only a few pence cheaper than the commercial rate. But with prices hitting around 50pence per kWH at their peak, businesses can make massive savings through a PPA with very little risk, so it makes complete business sense.

Smart Ease's role

Power Purchase Agreements (PPA) became quite popular during the feed-in tariff period financing solar installations,” Nick Neza Managing Director, said, “In the last 3 to 4 years, we have seen an increase of PPA’s and other funding options for commercial businesses where they are keen to keep the cash flow for other business operations so invest on solar PV using PPA’s and HPA’s”.

“However, more businesses are looking for ways to reduce their energy bills, and so we have partnered with Smart Ease payment solutions to make it easier and cost-effective for businesses to access PPAs and HPAs”.

Smart Ease provides an easy route to setting up PPAs and HPAs and provides access to other flexible funding solutions.

“We’ve been financing energy-efficiency equipment in Australia and New Zealand for over eight years now,” said Guy Olian, Smart Ease CEO. “Solar panels are much more widely used there, so the market for energy finance is also more mature.

“We’ve designed a fast and simple application process that makes it easy for customers to access the payment solutions they need, and we’re looking forward to offering it to businesses and organisations across the UK.”

Since 2014, Smart Ease has funded more than 10,000 projects, with customers including BP, Toyota, and Origin. From now, Excel Energy customers will be offered direct access to the Smart Ease payment platform.

Smart Ease PAYMENT Solutions FAQs

Smart Ease specialises in funding smart and energy-efficient technologies, equipment, and professional services. This includes solutions such as solar and energy storage, electric vehicle charging, water heating and purification, heat pumps, efficient lighting, voltage optimisation, power factor correction, chillers, boilers, HVAC systems, power generators, communication equipment, AV and multimedia systems, security and monitoring systems, and building automation.

Smart Ease payment solutions come with no upfront costs. Your expenses are spread over the duration of your Payment Plan, with payments typically made on a monthly basis.

You can select a payment term that best suits your business based on the monthly instalments.

For energy agreements, Smart Ease Payment Plans typically range from 2 to 10 years.

For smart equipment and technologies, the Payment Plans can extend up to 5 years.

No, your payments are fixed. Once the equipment is installed and settlement is complete, your monthly instalments are locked in for the entire term of the Payment Plan, meaning interest rate increases will not impact the payment amount.

No. There are no hidden charges or additional fees beyond your scheduled monthly repayments.

Choosing the right payment solution depends on a few factors including:

- how you want to manage your payments, and

- what works best from a tax perspective for your business.

We offer two types of Payment Plans – Rental and Hire Purchase Agreement (or Loan). These typically suit customers who don’t want to pay upfront, preferring to pay in manageable monthly instalments over a term (from 2−10 years).

For solar and storage projects only, customers also have the option of an onsite Power Purchase Agreement (PPA).

No. Businesses can only apply for a Smart Ease Payment Plan via one of our Accredited Channel Partners. As an approved Smart Ease Channel Partner, Excel Energy is available to help with your commercial energy efficiency.

The key differences between the options are ownership and tax treatment.

With a Rental Agreement, Smart Ease owns the equipment during the Payment Plan term, and you have the option to purchase it at the end. This is typically treated as a fully tax-deductible operating expense.

With a Hire Purchase Agreement, you own the equipment from the start and may be able to claim interest and depreciation on the equipment as tax-deductible expenses.

Smaller businesses (i.e. those that need a 70kW system or smaller), businesses that use electricity mostly outside daylight hours, or businesses that have peaky and inconsistent loads are better suited to a Payment Plan than a PPA.

Examples of businesses that may find a Payment Plan better than a PPA for their needs include businesses operating at night, seasonal businesses (such as fruit-picking) and production-run businesses (e.g. printer).

Onsite solar PPAs are ideal for large businesses that operate during daylight hours and that typically require big or complex systems. They are suited to both building owners and tenants.

A PPA best suits businesses that:

- have minimum monthly power bills of £2,000 or more

- have consistent loads, and

- prefer to outsource the maintenance and upkeep of the system.

PPAs are typically in place for 7−30 years, so they are best suited to businesses that are well established. Examples include shopping centres, schools, cold-storage facilities, distribution centres, supermarkets and agricultural businesses.

Onsite solar PPAs are ideal for large businesses operating during daylight hours and typically requiring big or complex systems. They are suited to both building owners and tenants.

A PPA best suits businesses that:

- have minimum monthly power bills of £1,500 or more

- have consistent loads, and

- prefer to outsource the maintenance and upkeep of the system.

PPAs are typically in place for 7−30 years, so they are best suited to businesses that are well established. Examples include shopping centres, schools, cold-storage facilities, distribution centres, supermarkets and agricultural businesses.

If you’d like to cut your energy costs without the responsibility of owning and maintaining a large solar system, an onsite PPA could be the best option for you. Unlike other PPAs that only suit owners, the Smart Ease PPA is suitable for both tenants and owners.

PPAs suit large businesses that operate mainly during daylight hours, have high energy needs and prefer a fully serviced solution. You’ll get accurate sustainability data for reporting and upgrades to your equipment as technology improves.

Once you confirm your solar project and sign your PPA, your commercial solar system will be installed at no upfront cost. You then buy the power generated by the solar panels at an agreed-upon low rate (approx. £0.09−£0.15/kWh) for the duration of your PPA.

Your PPA provider takes care of all repairs, maintenance and insurance. All you have to do is continue buying energy from your provider at a lower rate than you would from the grid!

Smart Ease payment solutions enable businesses to get equipment without tying up capital. Pay nothing upfront and instead pay manageable monthly instalments which helps with cash flow.

Specific benefits vary according to the payment solution, but all include freeing up capital so you can direct it towards other growth business opportunities. You can put your new equipment to work immediately while deploying your capital elsewhere.

If you’re investing in commercial solar PV systems or energy-efficiency equipment, your electricity costs will be lower as soon as your system is installed − often by up to 60%. The savings on your electricity bill are typically greater than the Payment Plan instalments, which makes the purchase cash-flow positive.

Depending on the payment solution you select, your equipment may be a fully tax-deductible operating expense, or you may be able to claim interest and depreciation expenses at tax time.

For businesses on a solar PPA, electricity used and paid for may be able to be claimed as a tax-deductible expense. Always speak to your accountant to determine how tax benefits apply to your specific situation.

It’s a simple four-step process.

First, complete our simple online form to apply and sign, and receive instant conditional approval for a Payment Plan up to £150k*.

Next, sign your Payment Plan agreement and the project is formally approved.

Your equipment will now be supplied and/or installed. Smart Ease will pay the supplier up to the agreed amount within 24−48 hours.

Finally, pay your Smart Ease monthly instalments for the term of your Payment Plan. For Rental Payment Plans, you’ll have the option to buy the equipment outright at the end of the term.

*Subject to holding an CRN for 2+ years and other credit criteria and approvals.

For PPAs, conditional approval can happen within minutes. Once additional information such as interval data is provided, formal approval can occur typically within 48 hours.

The internal rate of return (IRR) is a tool used in financial analysis to estimate the profitability of potential investments. It defines the amount of profit your business will gain by investing in a project or equipment as a percentage. For example, an IRR of 12% means you’ll make a profit of 12% per year on any funds invested in the project.

An IRR example for solar panel installation by Solar Choice[1] found that the IRR for commercial solar systems up to 100kW in size ranged between 24% and 37%. By comparison, the average IRR for commercial real-estate investment is 15%−20%.

It’s often harder to determine the IRR for smart tech. Cost-savings to consider are:

- reducing or eliminating fees for consultants and/or equipment hire, and

- avoiding lost productivity due to inefficient tools.

Payback period (PBP) is the time in years which it takes for the cash flow from a particular project to cover the initial investment. The shorter the payback period, the better.

All solar and energy-efficiency investments will experience a different PBP when the full cost of the system is paid upfront, depending on the size of the system and the percentage of required energy it’s able to cover. For a typical commercial system, the average PBP is around 4−5 years.

However, with a Smart Ease Payment Plan, there is no PBP, because you’re not investing anything initially. Your investment takes place throughout your Payment Plan, and in the case of solar equipment, it is often wholly funded by the savings you make on energy bills.

We understand that circumstances change. If you sell or otherwise move on from your business or premises, you may be able to novate your Payment Plan agreement to another party (subject to a fee and credit approval of the new entity)

All of our agreements are fixed-price contracts, i.e. a contractual agreement with a predetermined value for the goods or services provided. If you need to terminate your agreement early, please get in touch with us to provide an early termination payout figure.

Need support exploring smart ease flexible funding options

Whether you are looking to install solar panels, energy storage, EV Charging or other smart technologies, our team is ready to assist you in selecting the best financial solution. Contact us today to learn more about how we can support your transition to renewable energy with the right funding option for your business.