Commercial Solar financing

How To Get Commercial Solar Financing for solar panels in the uk

Switching to solar energy is now more accessible than ever, thanks to the flexible financing solutions provided by Excel Energy in partnership with Smart Ease.

With options like payment plans, hire purchase agreements and commercial solar financing from Smart Ease; you can find the perfect commercial solar solution to meet your business’s energy needs and budget.

We aim to help businesses reduce energy costs, improve sustainability, and eliminate the financial barriers to renewable energy adoption. Whether you want to pay over time or benefit from a fully serviced Power Purchase Agreement, we’ve got you covered.

What Is Solar Financing?

Solar panel finance refers to financial solutions that allow businesses to spread the cost of solar installation over time rather than paying upfront.

This makes it easier for businesses to adopt solar energy without straining their cash flow.

For commercial entities, commercial solar financing is designed to accommodate the needs of larger systems and energy demands.

Whether through loans, lease agreements, or Power Purchase Agreements (PPAs), these commercial solar panel financing options ensure businesses can reduce their reliance on the grid while benefiting from predictable energy costs.

How Does Commercial solar financing work?

With commercial solar panel financing, businesses can either purchase their solar system outright over time or pay only for the energy generated. Here’s how it typically works:

Application and Approval

Businesses apply for financing through commercial solar financing companies, often receiving quick conditional approval.

Installation

Once financing is approved, the system is installed, and the business begins benefiting from renewable energy.

Payment Plans

Monthly payments are spread over the agreed term, making the investment cash-flow positive from the start, as energy savings often offset the payment costs.

How To Secure Commercial Solar Energy Financing In the uk

Follow these steps to get started with commercial solar energy financing:

Step 1: Evaluate Energy Needs

Identify your business's energy usage and the required commercial solar panel system size.

Step 2: Research Providers

Compare commercial solar financing companies and their offerings, including PPAs, lease options, and hire purchase payment plans.

Step 3: Submit An Application

Most providers offer streamlined applications, with approvals for solar financing or PPAs often granted within 24–48 hours.

Step 4: Schedule Installation

Once approved, your system will be installed, allowing you to benefit from renewable energy immediately.

We proudly partner with Smart Ease to provide flexible payment solar panel finance solutions bespoke to the needs of every business and organisation.

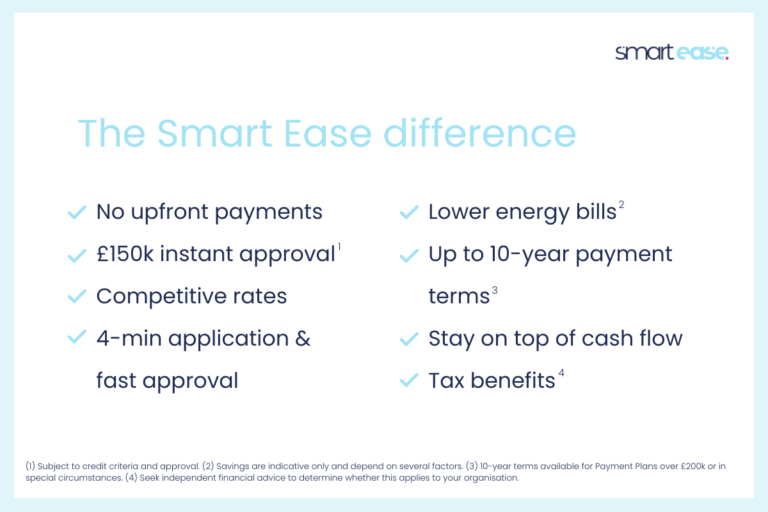

Smart Ease offers competitive rates, fast approval, and exceptional service for energy-efficiency equipment financing. We ensure our customers can access the best commercial solar panel financing payment options, making the transition to sustainable energy solutions fluid and affordable.

Discover Commercial Solar Panel Financing Options Today with Excel Energy and Smart Ease Solar Payment Plans

Commercial Solar Financing from Smart Ease the easy way to start saving

Investing in solar and energy-efficient equipment is a smart choice for reducing energy costs and decarbonising operations. However, upfront costs can sometimes be a barrier.

That’s where our partnership with Smart Ease comes in. As an industry specialist with over 11 years of expertise, Smart Ease provides flexible funding for commercial solar panels created for businesses like yours.

With Smart Ease’s competitive Payment Plans, you can spread the cost of your equipment over time – with £0 upfront, making it easier to start saving on energy while preserving your cash flow.

Solar Financing A helping hand with your cash flow

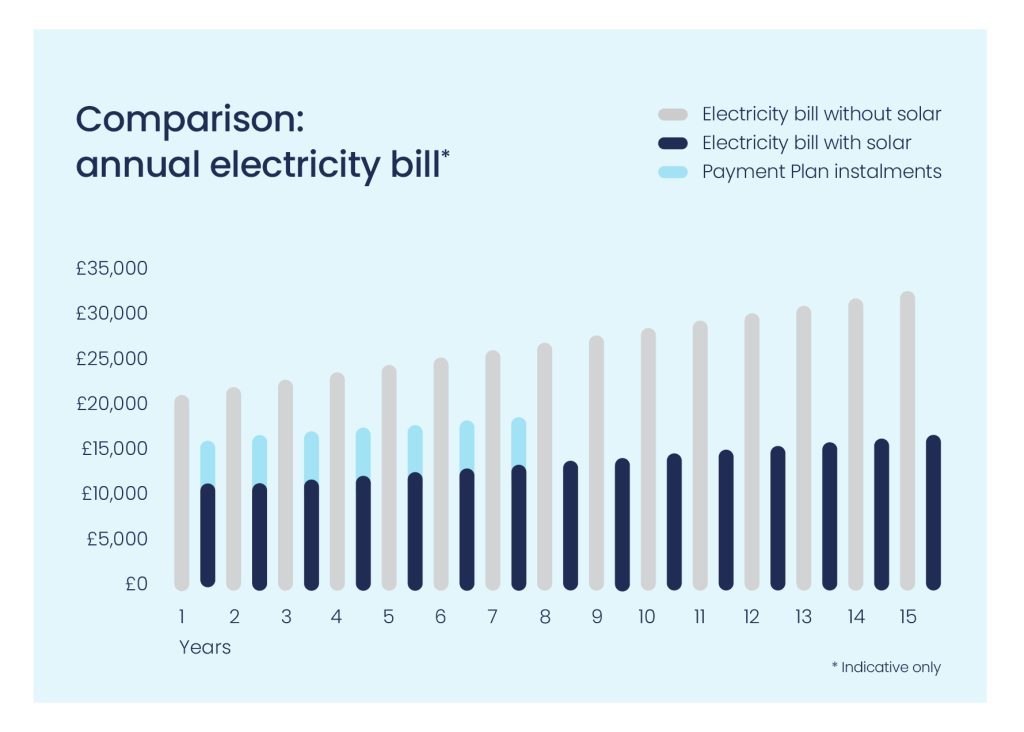

When you choose a Payment Plan for your equipment, the savings on your energy bills can often outweigh your instalments – putting cash back into your business.

Speak to our team today to discover how going solar can be a cash-flow positive solution for your business.

Fast approvals, no hassle

Benefit from competitive rates and quick approvals. With instant pre-approval available for Payment Plans up to £150k, your business can get the green light fast and have your new equipment up and running in no time.

Commercial Solar Funding options from Smart ease

Smart Ease provides a variety of flexible payment options made to suit your funding needs. Whether you’re investing in commercial solars, battery storage, EV chargers, HVAC, or other energy-efficient equipment, Smart Ease makes it simple to finance your upgrade.

Commercial Solar Financing options from Smart ease

Payment Plans

Smart Ease offers a range of Payment Plans for solar panels, battery storage, and related equipment, helping you start saving immediately, manage electricity costs effectively, and achieve your sustainability goals.

Designed for commercial solar projects of all sizes, Smart Ease Payment Plans are fast, simple, and 100% online. Applications for up to £150,000 can receive pre-approval in as little as 4 minutes.

We offer two flexible options: Rental and Hire Purchase Agreement (Loan). These plans are ideal for businesses looking to avoid upfront costs, instead opting for manageable monthly payments over a term ranging from 2 to 10 years.

difference between a Hire purchase agreemenet payment plan and a rental payment plan

The key differences come down to system ownership and tax treatment.

Hire Purchase Payment Plan

With a Hire Purchase Agreement your business owns the equipment from the start. You may be eligible to claim the interest and depreciation as tax-deductible expenses, providing additional financial benefits.

Rental Agreement Payment Plan

Smart Ease retains ownership of the equipment throughout the Payment Plan. At the end of the term, you have the option to purchase it. Rentals are typically treated as a fully tax-deductible operating expense.

Why Choose Excel Energy and Smart Ease for solar financing

Energy prices are increasing year on year for businesses, but many companies are saving money by introducing commercial solars.

With solar panel financing, there are no initial investment costs, and your business will start saving money from the day the system is installed.

Investing in solar panels for commercial buildings allows companies to secure predictable energy costs, offering more control over expenses and protection against rising energy prices.

At Excel Energy, we prioritise simplicity and customer satisfaction. Smart Ease commercial solar panel financing gives you access to clean, renewable energy without worrying about ownership or maintenance. It’s an effortless way to reduce your carbon footprint and energy costs while enjoying peace of mind knowing the system is expertly managed.

Start your solar journey today contact us to enquire how a Smart Ease solar panel finance solution can revolutionise your energy strategy!

Smart Ease PAYMENT Solutions FAQs

Smart Ease is a leading provider of funding solutions for smart and energy-efficient technologies, equipment, and professional services. Their offerings cover a broad range of innovative solutions, including solar and battery energy storage systems, BESS, electric vehicle (EV) charging stations, water heating and purification technologies, heat pumps, efficient lighting systems, voltage optimisation, power factor correction, chillers, boilers, HVAC systems, power generators, and more. Additionally, they support advanced systems like communication equipment, audiovisual (AV) and multimedia setups, security and monitoring solutions, and building automation technologies.

Smart Ease offers flexible payment solutions with no upfront costs. Expenses are distributed across the term of your Payment Plan, allowing for manageable monthly payments tailored to your budget.

Smart Ease allows you to choose a payment term that aligns with your business needs and budget through flexible monthly installments.

- Energy agreements: Payment Plans typically range from 2 to 10 years.

- Smart equipment and technologies: Payment Plans are available for up to 5 years.

No, your payments are fixed. After the equipment is installed and settlement is finalised, your monthly instalments remain constant throughout the entire Payment Plan term. This ensures that any interest rate increases will not affect your payment amount.

No, there are no hidden charges or unexpected fees. You only pay the scheduled monthly repayments as outlined in your Payment Plan.

Selecting the right payment solution depends on several factors, including:

- How you prefer to manage your payments.

- What aligns best with your business’s tax strategy.

Smart Ease offers two primary Payment Plans: Rental and Hire Purchase Agreement (or Loan). These options are ideal for customers who prefer to avoid upfront costs, opting instead for manageable monthly installments over a term ranging from 2 to 10 years.

For solar and energy storage projects, customers can also have an onsite Power Purchase Agreement (PPA) as an alternative funding solution.

No, businesses can only apply for a Smart Ease Payment Plan through one of our Accredited Channel Partners. As an approved Smart Ease Channel Partner, Excel Energy is ready to assist with your commercial energy efficiency needs.

The main differences between the options lie in ownership and tax treatment:

Rental Agreement: Smart Ease retains ownership of the equipment during the Payment Plan term, with the option for you to purchase it at the end. Payments under this arrangement are typically treated as a fully tax-deductible operating expense.

Hire Purchase Agreement: You take ownership of the equipment from the outset. This arrangement may allow you to claim tax deductions for interest and depreciation on the equipment.

Smaller businesses—such as those requiring a system of 70kW or less, businesses using electricity primarily outside daylight hours, or those with irregular or fluctuating energy demands—are often better suited to a Payment Plan than a Power Purchase Agreement (PPA).

Examples of businesses that may benefit more from a Payment Plan include:

- Businesses operating primarily at night.

- Seasonal operations, such as fruit-picking businesses.

- Production-based businesses with variable energy needs, such as printers.

Examples of businesses that may find a Payment Plan better than a PPA for their needs include businesses operating at night, seasonal businesses (such as fruit-picking) and production-run businesses (e.g. printer).

Onsite solar Power Purchase Agreements (PPAs) are an excellent option for large businesses that operate primarily during daylight hours and require substantial or complex solar systems. They are suitable for both property owners and tenants.

A PPA is ideal for businesses that:

- Have monthly power bills of £2,000 or more.

- Maintain consistent energy loads.

- Prefer to outsource the maintenance and upkeep of the solar system.

PPAs typically have terms ranging from 7 to 30 years, making them a great fit for well-established businesses. Examples include shopping centres, schools, cold storage facilities, distribution centres, supermarkets, and agricultural operations.

Onsite solar Power Purchase Agreements (PPAs) are ideal for large businesses that operate during daylight hours and require substantial or complex solar systems. They are suitable for both building owners and tenants.

A PPA is best suited for businesses that:

- Have monthly power bills of £1,500 or more.

- Maintain consistent energy loads.

- Prefer to outsource the maintenance and upkeep of the solar system.

PPAs, typically with terms ranging from 7 to 30 years, are designed for well-established businesses. Examples include shopping centres, schools, cold storage facilities, distribution centres, supermarkets, and agricultural enterprises.

If you’re looking to reduce energy costs without the burden of owning and maintaining a large solar system, an onsite Power Purchase Agreement (PPA) might be the ideal solution for you. Unlike many other PPAs designed exclusively for property owners, the Smart Ease PPA is tailored for both tenants and building owners.

PPAs are a great fit for large businesses that:

- Operate primarily during daylight hours.

- Have high energy demands.

- Prefer a fully serviced solution, including maintenance and upkeep.

With a Smart Ease PPA, you’ll benefit from accurate sustainability data for reporting purposes and access to equipment upgrades as technology evolves.

Once you confirm your solar project and sign your Power Purchase Agreement (PPA), your commercial solar system will be installed with no upfront costs. You’ll then purchase the electricity generated by the solar panels at a pre-agreed, competitive rate (typically £0.09−£0.15/kWh) for the duration of the PPA.

Your PPA provider handles all repairs, maintenance, and insurance, ensuring a hassle-free experience. All you need to do is enjoy the benefits of purchasing energy at a lower rate than from the grid!

Smart Ease payment solutions allow businesses to acquire equipment without tying up capital. With no upfront costs, you can make manageable monthly payments, helping to maintain healthy cash flow.

While specific benefits depend on the payment solution chosen, all options share the advantage of freeing up capital, enabling you to invest in other growth opportunities. This means you can start using your new equipment right away while channelling your resources into other areas of your business.

Investing in commercial solar PV systems or energy-efficient equipment can significantly reduce your electricity costs—often by up to 60%—starting as soon as your system is installed. In most cases, the savings on your electricity bills exceed the monthly Payment Plan instalments, making the investment cash flow positive from day one.

The tax benefits of your equipment depend on the payment solution you choose. It may qualify as a fully tax-deductible operating expense, or you may be eligible to claim interest and depreciation at tax time.

For businesses using a solar PPA, the cost of electricity consumed and paid for may also be tax-deductible. Always consult with your accountant to understand how these tax benefits apply to your specific circumstances.

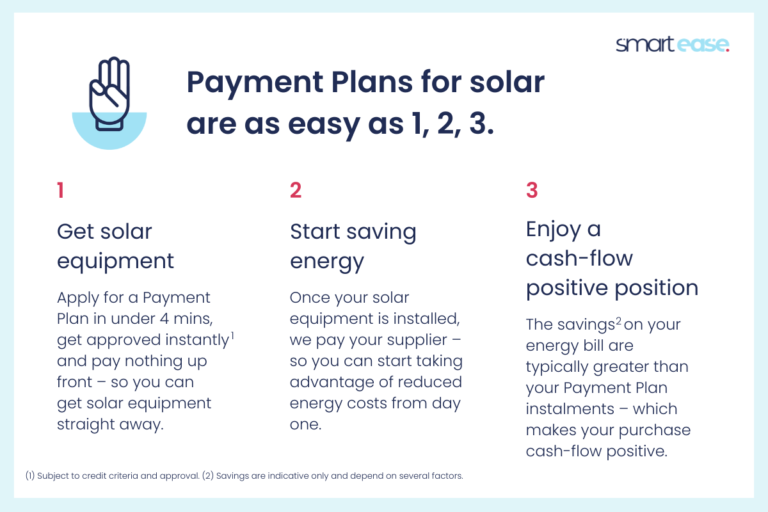

The process is quick and easy, with just four simple steps:

Apply Online: Complete our straightforward online application form to receive instant conditional approval for a Payment Plan of up to £150k.*

Sign Your Agreement: Once you sign your Payment Plan agreement, the project is formally approved.

Equipment Supply and Installation: Your equipment will be supplied and/or installed. Smart Ease will pay the supplier the agreed amount within 24–48 hours.

Make Monthly Payments: Pay your monthly Smart Ease installments for the term of your Payment Plan. For Rental Payment Plans, you’ll have the option to purchase the equipment outright at the end of the term.

*Subject to having a valid CRN for 2+ years and meeting other credit criteria and approvals.

For PPAs, conditional approval is often granted within minutes. Once additional details, such as interval data, are submitted, formal approval is typically completed within 48 hours.

The internal rate of return (IRR) is a financial metric used to assess the profitability of an investment. It represents the annualised percentage return your business can expect to earn on funds invested in a project or equipment. For instance, an IRR of 12% indicates a 12% annual profit on the investment.

For example, a study by Solar Choice[1] found that the IRR for commercial solar systems up to 100kW in size ranges between 24% and 37%. In comparison, the average IRR for commercial real estate investments is typically 15%–20%.

Calculating the IRR for smart technologies can be more complex, but key cost savings to consider include:

- Reducing or eliminating fees for consultants and equipment hire.

- Avoiding productivity losses caused by outdated or inefficient tools.

The payback period (PBP) is the time it takes for the cash flow from a project to recover the initial investment, measured in years. A shorter payback period is generally more desirable.

For solar and energy-efficiency projects, the PBP varies depending on the system’s size and the percentage of energy needs it covers. For a typical commercial solar system, the average PBP is around 4–5 years when the full cost is paid upfront.

With a Smart Ease Payment Plan, however, there is no traditional PBP because there’s no upfront investment. Instead, your payments are spread over the term of your plan. For solar equipment, these payments are often entirely offset by the savings you achieve on energy bills, making the investment effectively cash-flow neutral.

We understand that circumstances can change. If you sell or relocate your business or premises, you may have the option to transfer (novate) your Payment Plan agreement to another party, subject to a fee and the credit approval of the new entity.

All our agreements are fixed-price contracts, meaning the cost of goods or services is predetermined and agreed upon upfront. If you need to terminate your agreement early, please contact us to obtain an early termination payout figure.

Speak To our commercial Solar energy financing Experts

With Smart Ease, one of the leading commercial solar financing companies, you can start enjoying the benefits of renewable solar energy without the burden of upfront installation costs.

At Excel Energy, our extensive proficiency and expertise make us the trusted choice for businesses across the UK seeking commercial solar energy financing.

We provide specialised advice and guidance on commercial solar panels and financing options, ensuring you find the best solution.

Discover how your company can benefit from a solar panel financing today. Speak to our expert team by calling us on 0203 834 9440.